Construction workers Jake Holmgren and Jason Clement help install new heat pumps for residents in South Seattle, Washington. Marcela Gara, Resource Media via Flickr, CC BY-NC 2.0

The catastrophic power failures of the February 2021 winter storm in Texas put unprecedented strain, and attention, on the state’s power grid. Yet during the disaster and its aftermath, a trend that could have profound effects on energy use in Texas was quietly gathering momentum behind the scenes: the adoption of electricity-powered heat pumps for home heating and air conditioning.

According to the U.S. Energy Information Administration, 2.16 million heat pumps were being used in Texas in 2020 to heat and cool 21% of the state’s housing units. That’s more residential heat pumps than in any other state outside of Florida.

What’s already been a growing shift, driven by clear-cut energy savings as well as the desires of many to limit fossil fuel use, is set to accelerate over the next few years. A huge catalyst is the Inflation Reduction Act (IRA), passed by Congress and signed by President Joe Biden last summer. The IRA includes billions of dollars in both rebates and tax credits, all designed to help homeowners reduce their carbon footprint by making their homes more energy-efficient.

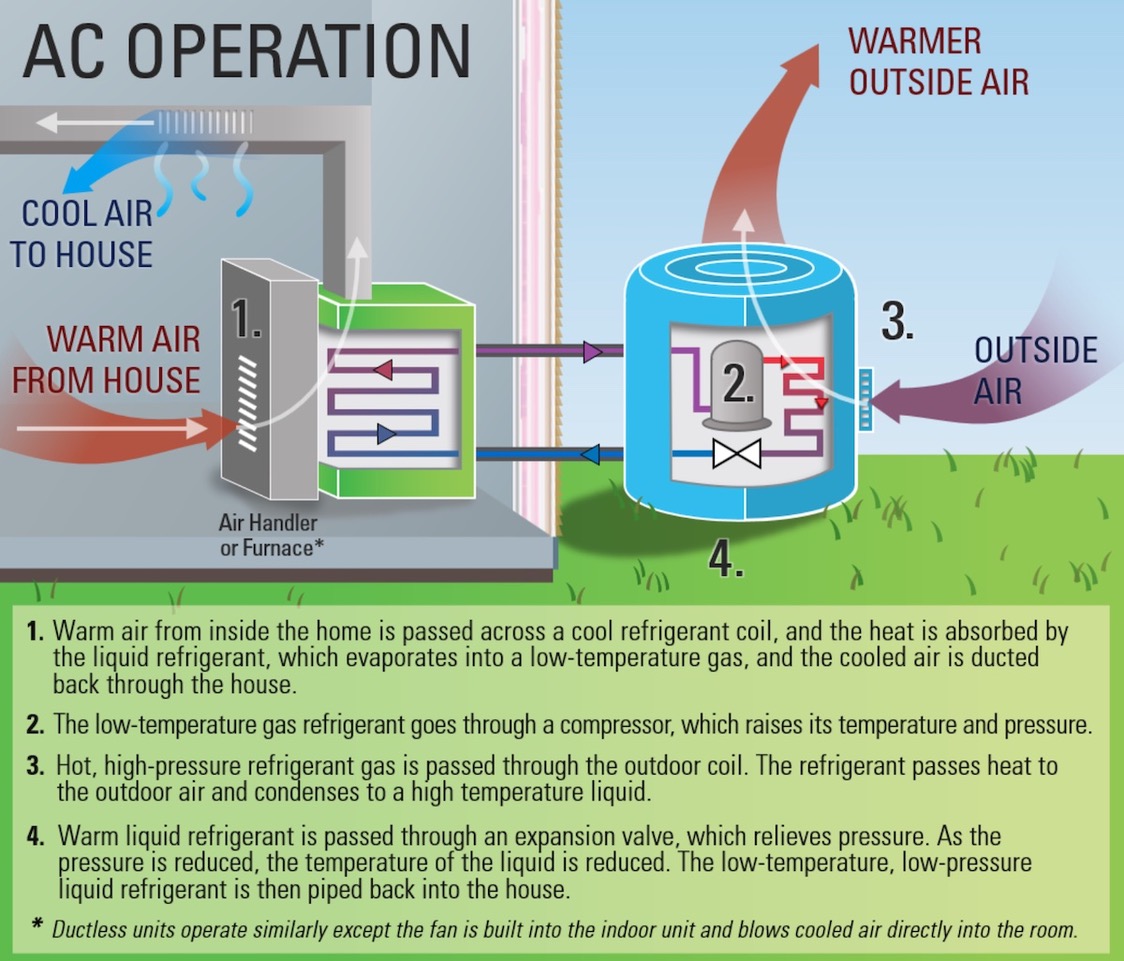

Spikes in natural gas and heating oil costs are adding new incentive to the nationwide boom in what are formally known as air-source heat pumps. These devices extract heat from air outside a home in cold weather and bring it inside; during hot weather, they transfer heat from inside to outside, thus serving as air conditioners. (Ground-source heat pumps, which can be even more efficient but are several times more expensive to install, use fluid-filled underground pipes to transfer heat to and from the soil.)

Infographics showing how an air-source heat pump works in heating mode (top) and air-conditioning mode (bottom). DOE/Energy Star

Infographics showing how an air-source heat pump works in heating mode (top) and air-conditioning mode (bottom). DOE/Energy Star

Although heat pumps aren’t a new idea – the first ones were developed in the 1800s – they’ve gone from strength to strength in recent years. Air-source heat pumps first gained widespread U.S. use across the South, which is understandable given that the machines were long limited in their ability to heat houses in temperatures well below freezing. However, some of the latest designs work well, if somewhat less efficiently, at temperatures well below 10 degrees F. Moreover, people switching to heat pumps have the option to keep a gas-fired furnace on hand as backup for the coldest days.

Some examples of the ongoing boom:

- Heat pumps now provide about 10% of all interior heating worldwide, with vast room for continued expansion, according to the International Energy Administration

- In Europe, the three countries with the largest fractions of households using heat pumps –all above 40% – are in chilly Scandinavia: Norway, Sweden, and Finland.

- For the first time, more heat pumps than gas furnaces were installed in the United States in 2022.

- The state of Maine has given rebates for 116,000 heat pumps, representing about 20% of all housing units in a state that’s long relied on heating oil.

- Even frigid Alaska is seeing a surge in heat-pump use.

An air-source heat pump, such as the outdoor portion of this ductless heat pump on a home in Dillingham, Alaska, takes heat from the outside air, runs it through a refrigeration cycle to step up the temperature (just like your fridge, but in reverse), and delivers it to a building. Tom Marsik, via NREL

Heat pumps can save hundreds of dollars throughout the year in energy costs, but they’re typically pricier to buy and install than conventional air conditioning and gas-powered furnaces. To get around that roadblock, the IRA will provide up-front (“point of sale”) rebates of 100% of the cost of equipment and installation costs of an Energy Star-level heating-and-cooling heat pump, up to $8000, provided that a household’s gross income is no more than 80% of its area median income (AMI).

Even for moderate-income households that earn as much as 150% of AMI, the IRA rebates will cover half of the costs of a heat pump, again up to a maximum rebate of $8000.

Roughly a third of the 10 million households in Texas should qualify for the full heat-pump rebate based on the 80% AMI threshold. In theory, a full rebate would pay for all or most of the cost of an air-source heat pump, depending on how prices evolve. More than half of Texas households would qualify for at least the 50% rebate.

Along with the rebates, a sheaf of updated federal tax credits collectively known as the Energy Efficient Home Improvement Credit will help offset up to 30% of the cost of a variety of energy efficiency measures. Up to $3200 in tax credit would be available each year.

The nonprofit Rewiring America has a nifty one-stop webpage with details on each of the rebates and tax credits available through the IRA based on one’s household size and income, homeowner status, location, and tax filing status.

The new IRA tax credits are already in effect, but it’ll take a while for the rebates to become reality. The IRA specifies that the roughly $9 billion in federal rebate funding through 2031 will be administered through the U.S. Department of Energy in partnership with state energy offices and tribal governments. DOE has been gathering public comment on the new measures; after digesting the input, they’re expected to issue guidance to states and tribes this summer.

According to an online FAQ, “It is likely that program rollouts will vary across states, but generally DOE expects households to be able to access these rebates in much of the country in late 2023/early 2024.”

State energy offices were established beginning in the late 1970s to help DOE implement weatherization assistance for low-income households. These offices’ portfolios have suddenly mushroomed, with the IRA rebates coming on the heels of more than $3 billion in new funding for weatherization efforts from the 2021 Bipartisan Infrastructure Law. (The Texas State Energy Conservation Office, which carries out a wide range of programs for individuals and businesses, did not respond to requests for input for this article.)

Preparing homes for tomorrow’s electric grid

About half of the $9 billion in IRA rebates is for the High-Efficiency Electric Home Rebate Act, which will include heat pumps, water heaters, stoves, and other equipment designed to nudge houses toward using electricity. The other half, dubbed the Whole Home Energy Reduction Rebates, or HOMES, will help install retrofits such as weatherstripping and insulation to serve lower-income occupants of single- and multi-family homes, with the rebate amounts linked to how much energy savings these fixes can provide.

Of course, the degree to which electrifying a home actually reduces fossil fuel use depends critically on the electric grid itself.

The assumption behind the IRA’s push for electrification is that national power grids will inevitably lean away from fossil fuels and toward renewables, said Lauren Urbanek, who oversees building-related activities within the Climate & Clean Energy Program of the nonprofit Natural Resources Defense Council (NRDC).

“We know the grid is going to continue to evolve into greener sources over time,” Urbanek told Texas Climate News. “Any electric appliance that’s been connected to the grid is going to benefit from the grid itself getting greener over time, whereas fossil-fuel appliances basically lock in their emissions for the life of the appliance.”

Efforts to green the Texas power grid may be hindered by a new mechanism prompted by the catastrophic grid failure of 2021. Approved in January by the Public Utility Commission, the Performance Credit Mechanism would award credit to utilities that keep power plants as backup. Environmental advocates fear that the measure, which may take years to implement, would reward the construction and maintenance of large fossil-fuel plants.

Another state policy may continue to tap the brakes on consumer fuel switching in Texas. A 2013 Texas law mandates that energy efficiency programs must be neutral “with respect to specific equipment or fuels…Utilities may not pay incentives for a customer to switch from gas appliances to electric appliances except in connection with the installation of high efficiency combined heating and air conditioning systems.”

Preparing for a home-energy windfall

Despite all the uncertainties at hand, it’s smart for consumers to get ready for the IRA incentives that’ll arrive soon, according to Noah Oaks, state and local policy manager for the Austin-based SPEER (South-Central Partnership for Energy Efficiency as a Resource). The nonprofit is designed to inform energy efficiency action among policymakers, businesses, and the public in Texas and Oklahoma.

“Residential and small commercial heating and cooling is what drives Texas peak demand periods, so having more higher-efficiency units would go a long way to reducing stress to the grid and save consumers money on their utility bills,” said Oaks.

Oaks encouraged those waiting for rebates to begin in Texas to learn more now about what would work best for their homes. “There are different types of heat pumps that are better suited for different climates or homes, so working with their utility and contractors to identify what their need is now could streamline the process later,” said Oaks.

“Performing a home energy audit would be a great step to see what else consumers could incorporate to increase the impact of a future heat pump – for example, coupling a heat pump with a smart thermostat.”

Weatherizing a home can also pair well with a heat pump. According to SPEER, “While air source heat pumps can work with most properties, you may not see the same efficiency benefits that you would have otherwise if your home has not been kept up to newer building code standards. In Texas, more than two thirds of homes are over 20 years old and may need additional upgrades like weather stripping, sealing ductwork or attic insulation to see the full benefit of heat pumps.”

NRDC’s Urbanek reiterated the value of an energy audit: “That could help get a lay of the land in terms of what’s out there now, and in some cases you might even have an audit subsidized by a utility or a local government.” Through its Weatherization Assistance Program, the Texas Department of Housing and Community Affairs provides local support for low-income residents working toward efficiency (see the TCN article from March 2022).

Members of the SPEER heat-pump working group recently told Oaks they believe that the IRA will support a “significant portion” of their Texas and Oklahoma business going forward. “Homeowners are also beginning to ask questions about the IRA,” said Oaks. “Some are opting to wait until more details are available before they make the investment in a new system.”

As demand for heat pumps continues to climb, HVAC vendors and installers will face new pressures to learn the ins and outs of heat pumps as well as the motivations driving consumers. When Urbanek recently looked into getting a heat pump in her Maryland home, she found some contractors weren’t immediately advising her on the particulars: “It was more like, you already have a gas furnace, why would you want a heat pump in this situation?”

On the plus side, she added, “Millions of homes already have heat pumps, so we’re not really talking about a new technology. The thing I think is going to have to evolve is contractors having the skills to understand and help people who are hoping to change from gas furnaces to heat pumps.”

Bob Henson, a meteorologist and science writer based in Colorado, is a contributing editor of Texas Climate News. He is the author of “The Thinking Person’s Guide to Climate Change,” published by the American Meteorological Society.